This post will mark the beginning of a series on Steve Keen’s book Debunking Economics. My first impression after reading his book was that it was chalk full of great ideas and solid criticisms of “neoclassical” economics as it is currently taught to undergraduate and graduate students. I’m not always fond of Keen’s tone, but isn’t some crank. I’m writing these posts in order to better retain the ideas and concepts expressed in the book, as well as to spark discussion. Other bloggers have also written about and summarized this book, and I will be linking to these posts as well. I’ll say that I don’t really have anything new to add to what has been perviously said, and I am doing this for my benefit.

Keen’s begins his criticism of neoclassical (micro) economics in chapter 3, which centers around the “Law of Demand” , i.e. the idea that market demand curves don’t necessarily slope downwards. This is in direct contrast to what is taught in an “Intro to Microeconomics” course, and subsequent economic courses use the assumption when explaining other concepts.

Market Demand Curves Don’t Slope Downwards

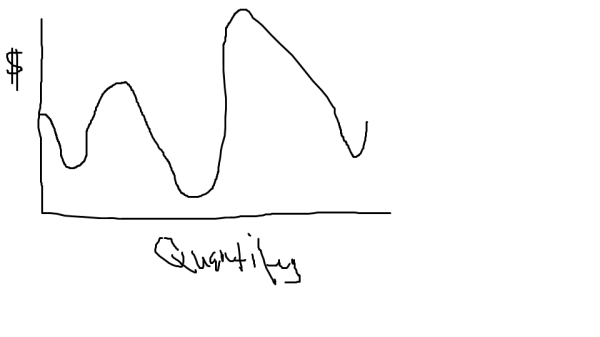

Economists look at demand curves to see how demand for a commodity changes as its price changes, while the consumer’s income remains constant. When you don’t make that assumption, things get complicated quickly. The decrease of price in one good raises the real income of the consumer (the income effect), allowing the consumer to increase the consumption of all goods, not just the good that has become cheaper. So in the case of Giffen Goods, because the rise in price of one good make another good unaffordable, you have a paradox where demand increases as prices rise. Consider necessary, luxury, and normal goods, and you have a very complicated picture and some interesting looking demand curves.

This is why economists make the distinction between the income effect and the substitution effect (if price falls, consumption rises and vice versa). The substitution effect is always negative and it’s what economists use to establish the “Law of Demand”. However, the income effect can be both negative and positive. So economists neutralize the income effect by using a Hicksian compensated demand function. The consumer is given a level of utility and a set of prices. The consumer then minimizes the amount of money that he/she would need to spend to achieve that given level of utility, thus separating the income effect and the substitution effect.

But once you introduce more than one agent into the economy, things don’t work out so nicely. With two economic agents, one person’s spending is another person’s income. It’s impossible to separate the income effect and the substitution effect, creating loads of complications for the “Law of the Demand”.

Economists have known this for years. One paper to mention this was written by William Gorman in 1953 (I give Keen a lot of credit for translating this terribly written paper):

We will show that there is just one community indifference curve locus through each point if, and only if, the Engel curves for different individuals at the same prices are parallel straight lines.

Because all utility functions pass through (0,0), this is essentially saying that all consumers have exactly the same preferences. This implies that there is only one consumer in the entire economy, an outright absurd assumption. Because Gorman’s paper was so opague, these results weren’t rediscovered until the 1970s, known as the Sonnenschien-Mantel-Debreu conditions.

But does any of this matter? Keen even admits that “there are some sound reasons why demand might generally be a negative function of price.” Well, it does matter, and there are three reasons why:

1. That contrary to what most lower level economics textbooks will tell you, markets don’t necessarily maximize social welfare.

2. It undermines the idea that “everything happens in equilibrium.” If we have a demand curve like the one above, then the resulting marginal revenue curve (the MR curve is derived from the demand curve) will be even more volatile. The marginal revenue curve will cross the marginal cost curve in multiple places, resulting in multiple points where “everything happens.”

3. The assumption of identical consumers is only valid when when we split society into different classes, which is what the Classical economists were trying to do. However, this approach isn’t used in neoclassical economics. The “one size fit all” treatment clearly has its limitations and macroeconomic theories shouldn’t necessarily be built up from individual behavior.

Links:

- Debunking Economics’, Part I: Demand Curves Can Have Any Shape by Unlearning Economics

References:

1. Gorman, W.M. (1953) ‘Community preference fields,’ Econometrica, 21(1): 63-80

2. Keen, Steve. Debunking Economics: The Naked Emperor Dethroned? London: Zed Book, 2011. Print.